Case study

Energisa

Designing and launching a new digital bank

Digital Design

2019–2020

Roles

Product Strategy

UX/UI

Prototyping

User testing

Documentation

Team

Questtono Manyone

Energisa (client)

Award

Brasil Design Award 2022

Overview

Collaborating with Energisa, one of Brazil's largest energy providers, I helped design and launch a brand new mobile banking solution usable by millions of previously 'unbanked' people.

What I did

- Defined and mapped the product strategy together with our research & strategy team and the client

- Led the team in the UX and UI design phase

- Prototyped the key interactions and experiences of the app

- Conducted user testing sessions alongside the research team

- Helped build documentation of the experience for the development phase

- Presented the final user experience to the CEO and board of directors of Energisa

The outcome

A spin-off startup from Energisa was launched in January 2021. It brought a new user experience to the digital banking market, reaching over 1 million customers in the first 2 years of operation.

Website: https://www.contavoltz.com.br/

User research and product strategy

Our research team went to four different cities across Brazil (João Pessoa and Patos, in Paraíba state; and Presidente Prudente and Bragança Paulista, in São Paulo state) to talk to people to understand their aspirations and needs.

To share our learnings, we conducted workshops and design sprints with all the key stakeholders to align the brand strategy and the product vision, bringing them to participate in a co-creation process.

Chat as the main user interface

Our main insight into our final user experience was that the internet for these people was synonymous with WhatsApp and Facebook. To them, most of the digital interactions happen inside those two apps.

Therefore, we took this insight and asked ourselves: "What if our digital bank talked to the users as if they were sending a message on WhatsApp?".

This led to our main core user experience that all the interactions would happen as if the bank is having a friendly chat with you. You would only need to say what you want to do ("I want to... transfer money / pay a bill / recharge my phone") and the bank would send a question back asking for the next information it needs ("To whom? / What is the amount? / When do you want to do this transaction?").

This main insight, in addition to the core user experience of the app, also guided the brand identity that the visual design team crafted beautifully.

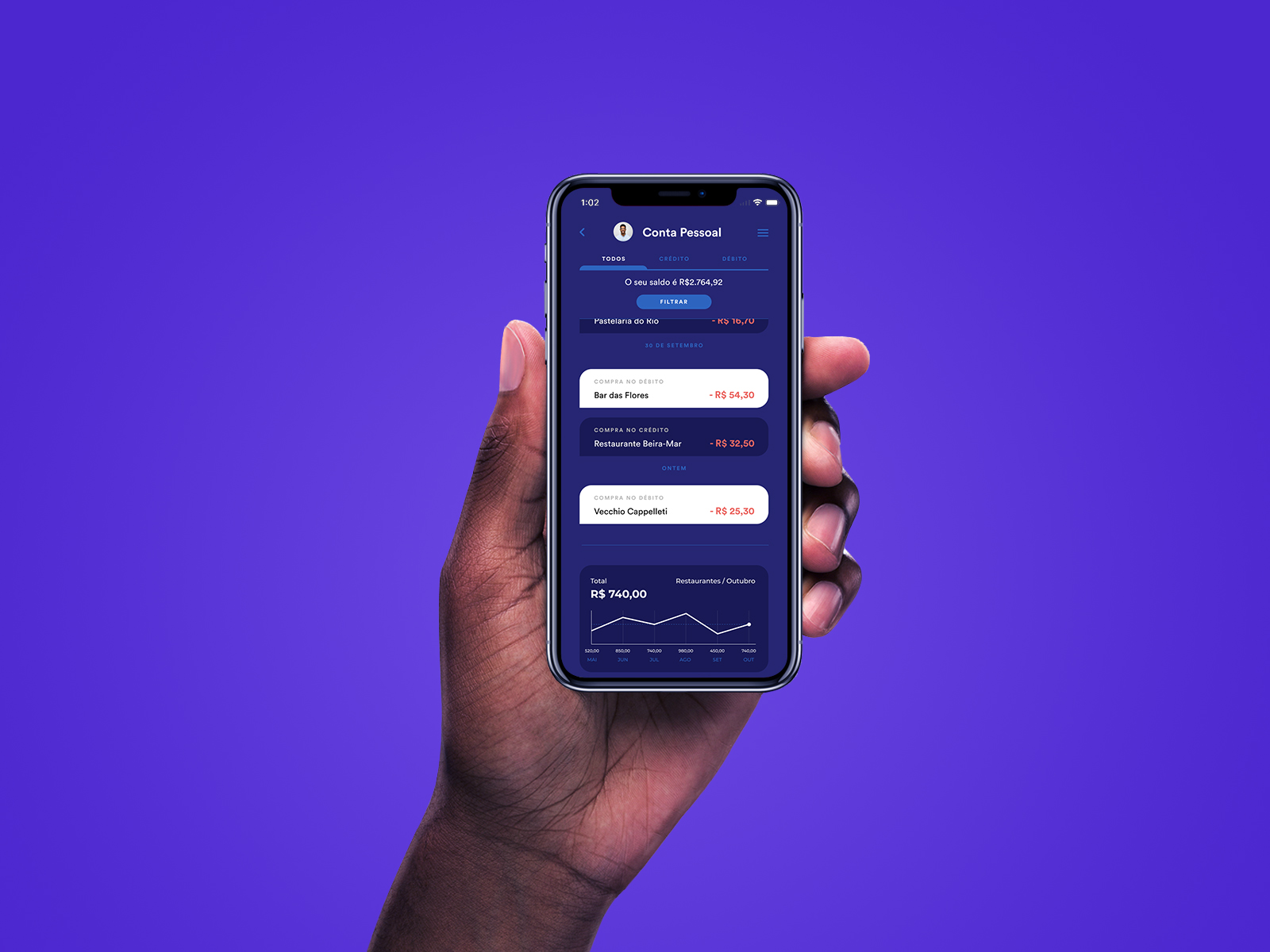

Two accounts in the same login

Another key insight was that most of our target users are small business owners and therefore have two types of accounts: personal and business. We identified that managing the two separate accounts makes financial management a hard task, as their businesses are intertwined with their personal lives.

This led us to create a unique login that the user can access both accounts, empowering them to have more financial control in their personal and business lives at the same time.

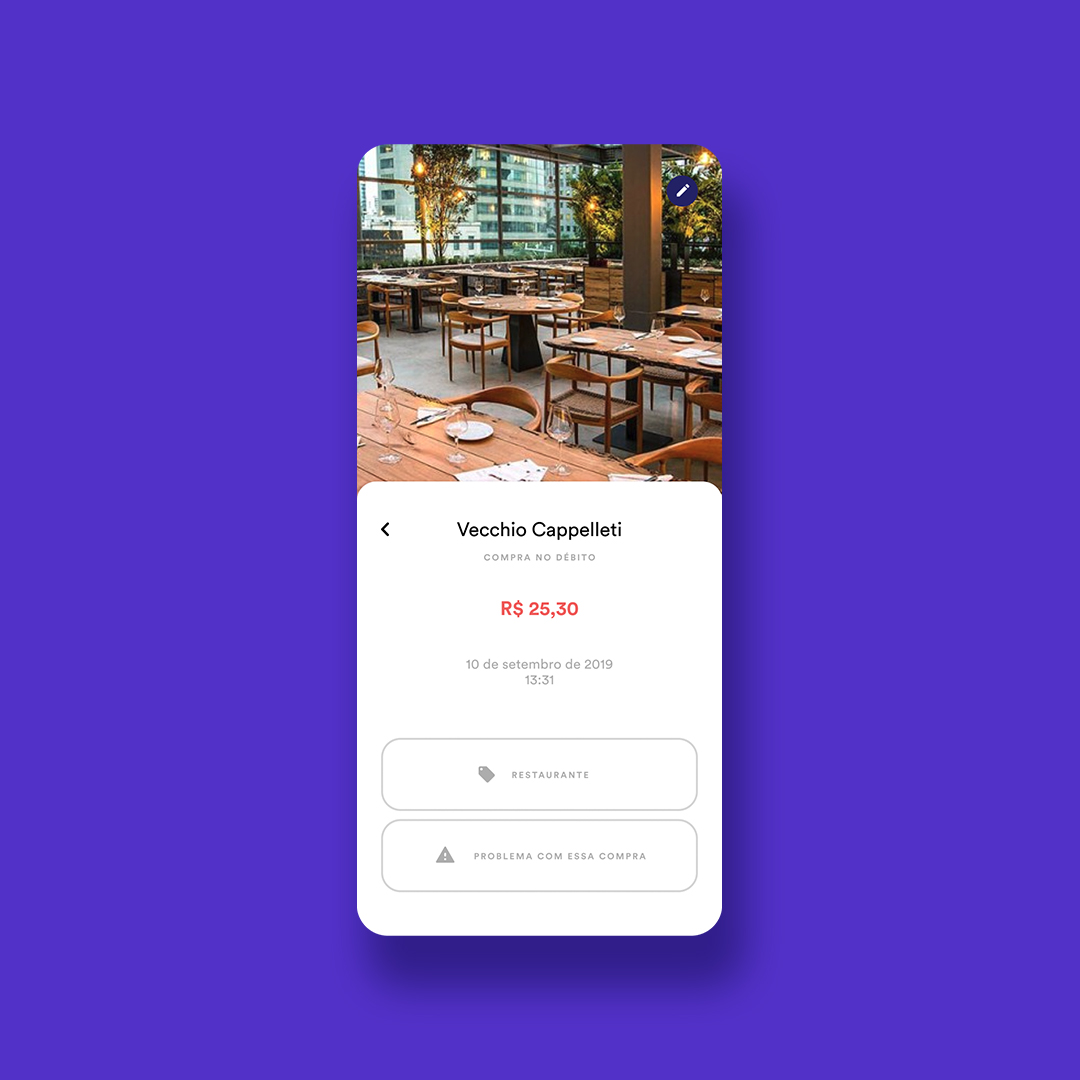

A human-centric bank statement

We introduced a new way to view your bank statement, following the idea of a continuous conversation with the platform.

The user can scroll up and see their purchase history, as it was their previous "messages" to the bank, creating a familiar and intuitive interaction with their expenses.

Splitting bills

Another important insight we identified was the need to split bills. People usually have to separate their household bills between family members or friends who live together under the same roof.

Therefore, we created a feature where, during the payment flow, users can select who they want to split from their contact list and the amount each one has to pay. All the other members receive a notification of how much they need to pay.

The main user can view all the bills that are currently in process, see who already paid and who hasn't, and edit the members and the amount that each one is paying.

Onboarding

In addition to the sign-up experience, we designed the onboarding experience introducing the main features and the user interface.

User testing and documentation

To test our hypotheses, we prototyped the core experiences and went to the same cities in the countryside of Brazil to test with customers and get their feedback.

This led us to a new round of refinement and to our final style guide and documentation for development.